IRSAL Microfinance Bank (NMFB) Launches Exciting OBL Loans: Everything You Need to Know

IRSAL Microfinance Bank (NMFB) Launches Exciting OBL Loans: Everything You Need to Know

Introduction

IRSAL Microfinance Bank (NMFB) is thrilled to introduce its latest financial offering – the OBL Loans. Designed to empower individuals and businesses alike, these new loans promise to be a game-changer in the world of microfinance. Whether you’re a budding entrepreneur seeking capital or a salaried employee with financial aspirations, OBL Loans have got you covered. In this post, we’ll delve into the key features, benefits, and eligibility criteria of this exciting new financial product.

What are OBL Loans?

OBL Loans, short for “Opportunity-Based Loans,” are a revolutionary addition to IRSAL Microfinance Bank’s diverse range of financial products. These loans are strategically crafted to provide financial support to those seeking to seize opportunities and turn their dreams into reality. With flexible terms, competitive interest rates, and an efficient application process, OBL Loans aim to be a reliable and accessible solution for borrowers from all walks of life.

Key Features and Benefits

- Wide Range of Loan Amounts: OBL Loans cater to a diverse audience, offering a wide range of loan amounts to choose from. Whether you require a modest sum or a more substantial financial boost, NMFB has tailored loan options to meet your specific needs.

- Flexible Repayment Options: NMFB understands that each borrower’s financial situation is unique. Hence, OBL Loans come with flexible repayment options, ensuring that you can comfortably repay the loan without undue stress on your finances.

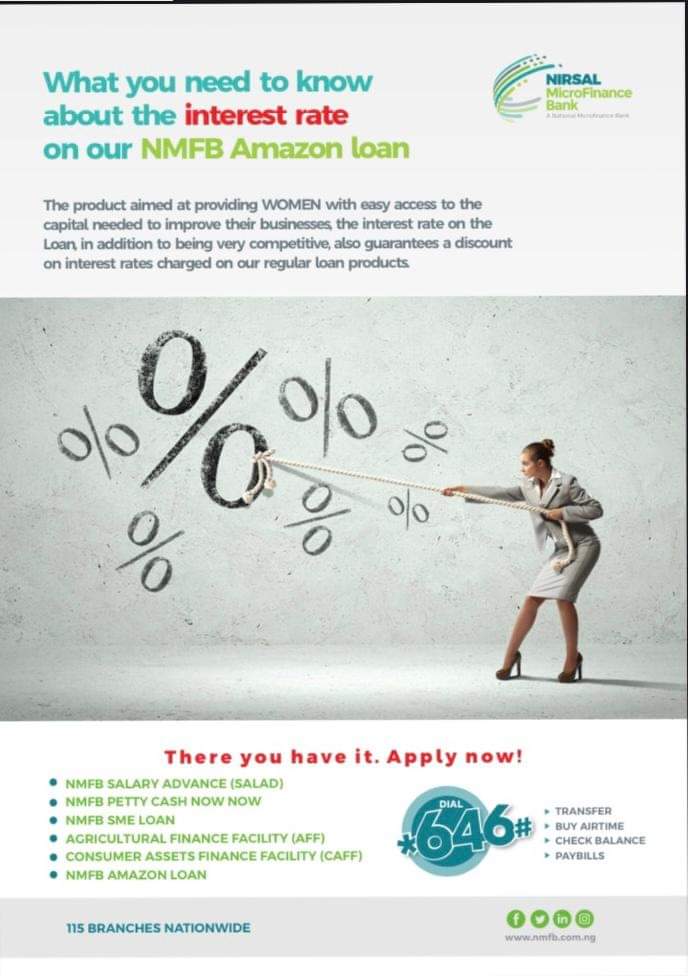

- Competitive Interest Rates: The bank is committed to providing its customers with transparent and competitive interest rates. OBL Loans are designed to be affordable, making sure that borrowers can focus on their ventures without the burden of exorbitant interest charges.

- Quick and Easy Application Process: Time is of the essence when opportunities arise. NMFB acknowledges this and has streamlined the loan application process for maximum efficiency. With minimal paperwork and quick approvals, you can swiftly avail yourself of the OBL Loans.

- No Collateral Required: OBL Loans are unsecured, which means you won’t need to pledge any collateral to secure the loan. This opens doors for more individuals, including those who lack significant assets, to access financial support.

Eligibility Criteria

To be eligible for OBL Loans, applicants must meet the following basic criteria:

- Age: Applicants must be at least 18 years old.

- Nigerian Citizenship: OBL Loans are exclusively available to Nigerian citizens.

- Steady Income: Demonstrable proof of income or a viable source of repayment is required.

- Creditworthiness: Applicants’ credit history and repayment capacity will be evaluated during the loan approval process.

NIRSAL Microfinance Bank (NMFB) has announced a new loan called OBL Apply Now

NIRSAL Microfinance Bank (NMFB) has announced a new loan called OBL Loans, NMFB loans are commercial and not CBN intervention. Therefore, if you want to get a loan for more money for your business, then this is an opportunity

OBL loans are loans that need to grow your business, pay rent buy a car, and pay school fees

The applicant for an OBL loan must provide personal information such as

- Full Name

- BVN

- Contact

- Home address

- your Business address

- In addition, the minimum OBL loan amount is 50,000 Naira.

There are 3 types of OBL Loans

- Pretty Cash now now

- SME

- SALAD

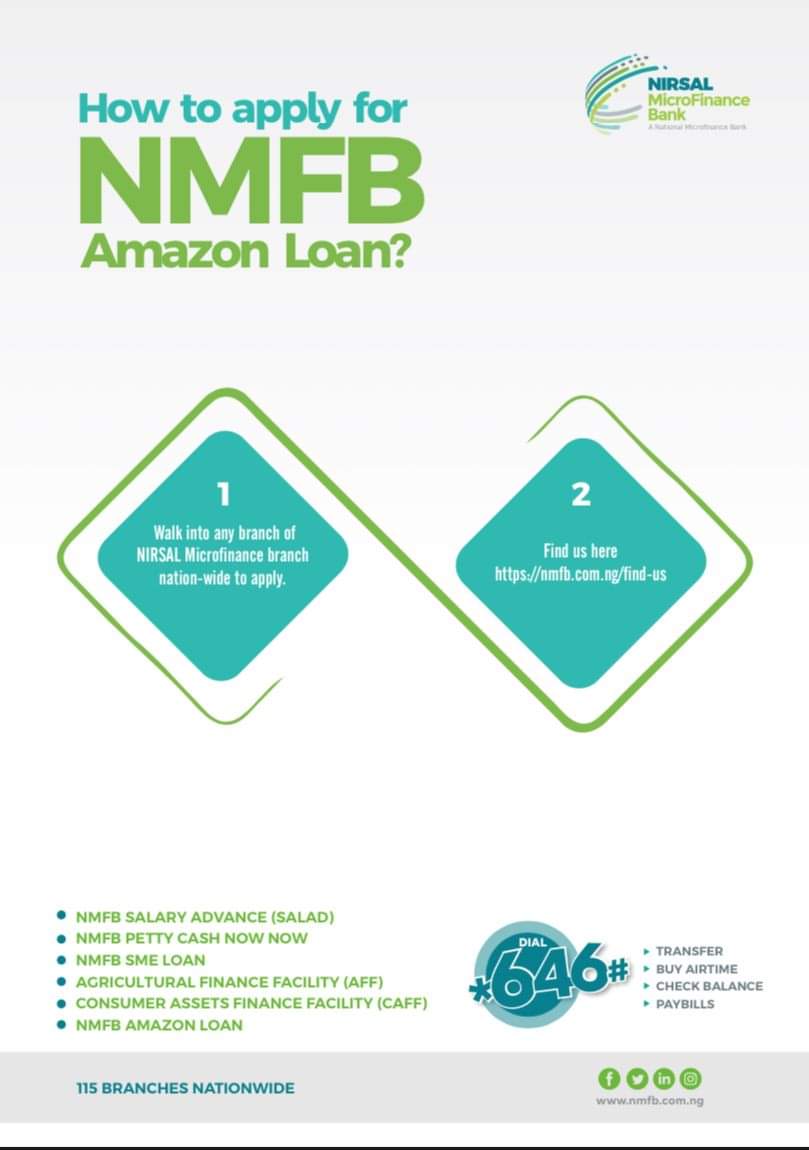

Method for Applying for NMFB OBL Loans Entrepreneurs interested in NMFB OBL Loans should visit the OBL Loans Portal to apply.

Conclusion

IRSAL Microfinance Bank’s introduction of the OBL Loans presents an excellent opportunity for aspiring entrepreneurs, professionals, and individuals seeking financial assistance to take advantage of exciting prospects. With its customer-centric approach, flexible terms, and hassle-free application process, OBL Loans are poised to transform lives and uplift communities. So, don’t miss out on this chance to unlock your potential with the support of IRSAL Microfinance Bank’s OBL Loans. Apply today and step closer to achieving your dreams!

arewanahiya.com