Exploring the Role and Functions of the Nigerian Customs Service

Exploring the Role and Functions of the Nigerian Customs Service

Introduction

In the world of international trade, customs services play a pivotal role in ensuring the smooth flow of goods across borders. One such institution is the Nigerian Customs Service (NCS). With its multifaceted responsibilities, the NCS is not only a crucial regulatory body but also a revenue generator for the Nigerian government. In this blog post, we’ll delve into the key functions, challenges, and importance of the Nigerian Customs Service.

Understanding the Nigerian Customs Service

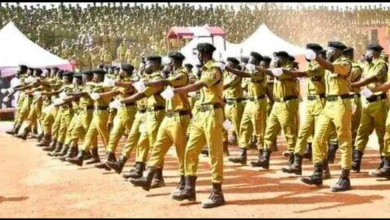

The Nigerian Customs Service is a government agency tasked with the responsibility of controlling and regulating imports and exports, collecting customs revenue, and facilitating international trade. Established in 1891, the NCS has evolved over the years to meet the changing dynamics of global trade. Its primary role is to ensure compliance with trade regulations and promote economic development through effective customs administration.

Key Functions and Responsibilities

- Revenue Collection: One of the primary functions of the NCS is revenue collection. Customs duties, excise duties, and other import-related taxes contribute significantly to the Nigerian government’s revenue stream. This income supports various public services and development initiatives.

- Trade Facilitation: The NCS aims to facilitate legitimate trade by streamlining customs procedures and reducing bureaucratic hurdles. Through modernization and automation, the agency seeks to expedite the clearance of goods at ports and border points, enhancing overall trade efficiency.

- Customs Enforcement: Preventing smuggling and enforcing trade regulations are essential for protecting local industries and national security. The NCS employs various strategies and technologies to detect and prevent illicit trade activities.

- Intellectual Property Rights Protection: The NCS also plays a role in safeguarding intellectual property rights by preventing the importation of counterfeit goods that could damage both the economy and consumers.

- Trade Data Collection and Analysis: Accurate trade data is crucial for policy formulation and decision-making. The NCS collects and analyzes trade statistics to provide insights into the country’s trade patterns and trends.

Challenges and Initiatives

While the NCS plays a vital role in Nigeria’s economy, it faces several challenges, including:

- Smuggling: The porous nature of some borders makes smuggling a significant concern. The NCS constantly works to enhance border security and curb illicit trade.

- Corruption: Like many institutions, the NCS has battled issues of corruption. Efforts to increase transparency and accountability are ongoing.

- Infrastructure and Automation: Insufficient infrastructure and outdated technology can hamper trade efficiency. The NCS has been investing in modernization and automation to address these issues.

- Trade Harmonization: The NCS collaborates with other agencies to ensure trade regulations align with international standards and agreements, promoting smoother cross-border trade.

The Engine of Economic Growth: Revenue Collection by the Nigerian Customs Service

In the realm of economic development, revenue collection is the lifeblood that fuels government initiatives and public services. In Nigeria, the Nigerian Customs Service (NCS) stands at the forefront of revenue generation through its meticulous and strategic approach to collecting customs duties, excise duties, and other import-related taxes. In this blog post, we will delve into the critical role revenue collection plays in Nigeria’s economic landscape and how the NCS executes this essential function.

The Importance of Revenue Collection

Revenue collection serves as the backbone of government funding, enabling the execution of critical projects and services that contribute to citizens’ well-being. From building infrastructure to providing healthcare, education, and security, the revenue collected by the NCS supports a range of initiatives that ultimately drive economic growth and stability.

Customs Duties and Excise Duties

Customs duties are imposed on imported goods as they cross the national border. These duties are not only a source of revenue but also serve to protect domestic industries by making imported products less competitive. The NCS assesses the value of goods, applies the appropriate tariff rates, and collects the associated customs duties, contributing substantially to the national coffers.

Excise duties, on the other hand, are taxes levied on specific goods produced domestically, such as alcohol, tobacco, and luxury items. By imposing excise duties, the NCS not only generates revenue but also influences consumption patterns and promotes public health.

Enhancing Revenue Collection Efforts

The NCS employs several strategies to enhance revenue collection while maintaining trade efficiency and compliance:

- Risk Management: Advanced risk management systems allow the NCS to identify high-risk shipments and allocate resources effectively for inspection. This approach maximizes revenue collection while minimizing disruptions to legitimate trade.

- Technology and Automation: Modernization initiatives have led to the adoption of advanced technologies, such as electronic customs clearance systems and automated valuation methods. These innovations streamline processes and reduce human error, ensuring accurate revenue assessment.

- Capacity Building: Ongoing training programs for customs officials ensure they stay updated on evolving trade practices, tariff classifications, and valuation methods. This knowledge equips them to make accurate revenue assessments.

- Trade Facilitation: Balancing revenue collection with trade facilitation is crucial. The NCS aims to expedite legitimate trade by simplifying customs procedures, reducing clearance times, and promoting a business-friendly environment.

The Nexus of Revenue and Economic Growth

The revenue collected by the NCS has a cascading effect on Nigeria’s economy:

- Funding Public Services: The revenue collected directly funds public services and development projects, including critical sectors like education, healthcare, and infrastructure.

- Investment Attraction: A stable revenue base enhances Nigeria’s creditworthiness, attracting foreign investment and supporting economic diversification.

- Fiscal Sustainability: Adequate revenue collection contributes to fiscal sustainability, reducing the need for excessive borrowing and promoting stable economic growth.

Facilitating Trade for Prosperity: The Vital Role of the Nigerian Customs Service

In an interconnected global economy, trade facilitation is the key to unlocking economic growth, improving competitiveness, and fostering international cooperation. The Nigerian Customs Service (NCS) serves as a linchpin in this process, working to streamline customs procedures, reduce bureaucratic barriers, and enhance the efficiency of cross-border trade. This blog post will delve into the critical role of trade facilitation in Nigeria’s economic development and how the NCS is driving this transformative process.

The Essence of Trade Facilitation

Trade facilitation encompasses a range of activities aimed at simplifying and expediting the movement of goods across borders. It involves reducing transaction costs, minimizing delays, and ensuring seamless coordination among various stakeholders, including customs authorities, traders, transporters, and regulatory agencies. By doing so, trade facilitation encourages increased trade volumes and bolsters economic growth.

NCS and Trade Facilitation: Key Initiatives

The Nigerian Customs Service has undertaken several strategic initiatives to enhance trade facilitation:

- Electronic Customs Clearance: The NCS has implemented electronic customs clearance systems that allow traders to submit documentation and declarations digitally. This minimizes physical paperwork, reduces processing time, and promotes transparency.

- Risk Management: Advanced risk assessment technologies enable the NCS to identify high-risk shipments for inspection, ensuring that resources are allocated efficiently and that legitimate trade flows smoothly.

- Single Window Platform: The NCS has collaborated with other government agencies to establish a single window platform, where traders can submit all necessary documents and information in one place. This reduces duplication, enhances coordination, and simplifies the clearance process.

- Pre-Arrival Processing: Through pre-arrival processing, the NCS enables traders to submit necessary documentation before the goods arrive, allowing for quicker processing and reduced dwell times at ports.

- Public-Private Partnerships: Collaborations between the NCS and private sector stakeholders, such as port operators and logistics companies, lead to coordinated efforts in improving infrastructure, customs procedures, and overall trade efficiency.

Economic Impact of Trade Facilitation

Effective trade facilitation driven by the NCS yields a range of economic benefits:

- Competitiveness: Reduced trade barriers and efficient customs processes enhance Nigeria’s attractiveness as a trading partner, fostering increased foreign direct investment and boosting the competitiveness of local industries.

- Cost Reduction: Streamlined procedures minimize delays and associated costs, making imports and exports more cost-effective for traders.

- Job Creation: A thriving trade environment leads to increased economic activity, creating job opportunities across various sectors, including transportation, logistics, and manufacturing.

- Revenue Growth: While trade facilitation aims to expedite processes, it also results in higher trade volumes, contributing to increased revenue collection for the government.

Safeguarding Borders and Commerce: The Essential Role of Customs Enforcement by the Nigerian Customs Service

In an increasingly interconnected world, the effective enforcement of customs regulations is paramount to ensure national security, protect domestic industries, and combat illicit trade. The Nigerian Customs Service (NCS) serves as the frontline defense against smuggling, counterfeiting, and other illegal activities that could undermine the country’s economy and safety. In this blog post, we will explore the crucial function of customs enforcement carried out by the NCS and its significance in maintaining a secure and thriving trade environment.

The Significance of Customs Enforcement

Customs enforcement refers to the activities undertaken by the NCS to prevent and deter illegal trade practices, including smuggling, tax evasion, and the importation of prohibited goods. By ensuring compliance with trade regulations and detecting and intercepting illicit activities, customs enforcement plays a vital role in safeguarding the country’s economic and social interests.

Key Aspects of Customs Enforcement

The Nigerian Customs Service employs various strategies and tools to effectively enforce customs regulations:

- Risk-Based Inspections: Advanced risk assessment techniques enable the NCS to identify high-risk shipments and focus resources on inspections that are most likely to yield positive results.

- Modern Technology: The use of modern technologies such as scanners, X-ray machines, and electronic cargo tracking systems enhances the NCS’s ability to detect hidden contraband and illicit goods.

- Collaboration: The NCS collaborates with other law enforcement agencies, both domestically and internationally, to share intelligence, exchange information, and coordinate efforts against transnational criminal networks.

- Capacity Building: Continuous training of customs officials in the latest enforcement techniques, legal procedures, and emerging trends is essential for maintaining a skilled and vigilant workforce.

- Public Awareness: Educating the public about the dangers of smuggling, counterfeit products, and illegal trade practices fosters a sense of responsibility among citizens and traders.

Combatting Smuggling and Illicit Trade

Customs enforcement by the NCS is instrumental in tackling the challenges posed by smuggling and illicit trade:

- Protecting Domestic Industries: Effective enforcement helps prevent the inflow of smuggled goods that could undercut local businesses and industries.

- National Security: Intercepting illegal shipments, including arms and drugs, contributes to maintaining national security by disrupting criminal networks and activities.

- Revenue Protection: Smuggling and illicit trade result in revenue losses for the government. Strong enforcement measures help preserve legitimate revenue streams.

- Public Health and Safety: Preventing the importation of substandard or counterfeit goods, such as medicines or electrical products, protects public health and safety.

The NCS’s Role in Economic Development

The NCS’s customs enforcement efforts extend beyond security; they have profound implications for Nigeria’s economic development:

- Fair Competition: By preventing smuggling and counterfeit goods, the NCS ensures a level playing field for legitimate businesses and traders.

- Investor Confidence: A robust customs enforcement regime enhances investor confidence, signaling a commitment to rule of law and safeguarding investments.

- International Trade Reputation: Effective customs enforcement contributes to Nigeria’s reputation as a responsible and reliable trading partner on the global stage.

Guardians of Creativity: The Role of the Nigerian Customs Service in Intellectual Property Rights Protection

In the modern global economy, protecting intellectual property rights (IPR) is paramount to foster innovation, creativity, and fair competition. The Nigerian Customs Service (NCS) plays a crucial role in safeguarding these rights by preventing the importation of counterfeit and pirated goods that can harm both the economy and consumers. In this blog post, we’ll delve into the significance of intellectual property rights protection, how the NCS contributes to this endeavor, and the positive impact it has on Nigeria’s economy.

Understanding Intellectual Property Rights Protection

Intellectual property refers to creations of the mind, such as inventions, literary and artistic works, designs, symbols, names, and images used in commerce. These creations are protected by law through patents, copyrights, trademarks, and other forms of intellectual property rights. Protecting these rights not only rewards creators for their efforts but also fosters an environment conducive to innovation and creativity.

The NCS’s Role in IPR Protection

The Nigerian Customs Service plays a vital role in enforcing intellectual property rights protection through the following mechanisms:

- Border Enforcement: The NCS works to prevent the importation of counterfeit and pirated goods by inspecting shipments at ports of entry. This involves identifying and detaining goods that infringe on trademarks, copyrights, and patents.

- Collaboration with Right Holders: The NCS collaborates with intellectual property right holders, such as brand owners, to share information and intelligence on potential infringing shipments.

- Training and Capacity Building: Customs officials undergo training to recognize counterfeit and pirated goods, enhancing their ability to identify and seize infringing products.

- Advanced Technology: Modern technology, such as scanning devices and databases, assists customs officers in identifying counterfeit products that may be concealed within legitimate shipments.

- Public Awareness: The NCS engages in public awareness campaigns to educate consumers and traders about the dangers of counterfeit products and the importance of supporting genuine goods.

Impact on Economy and Society

Effective intellectual property rights protection, facilitated by the NCS, has wide-ranging benefits:

- Encouraging Innovation: By protecting creators’ rights, intellectual property enforcement encourages innovation and investment in research and development.

- Supporting Local Industries: Intellectual property rights protection prevents the flooding of markets with cheap counterfeit goods, enabling local industries to thrive.

- Quality Assurance: Counterfeit products are often substandard and pose risks to consumer safety. By preventing their entry, the NCS helps maintain quality standards.

- Attracting Foreign Investment: A strong IPR protection regime signals a commitment to intellectual property rights, which can attract foreign investment and technology transfers.

Conclusion

The Nigerian Customs Service is a crucial player in Nigeria’s economic landscape. From revenue collection to trade facilitation and enforcement, the agency’s functions contribute to the country’s growth and development. By addressing challenges and embracing modernization, the NCS is striving to enhance its efficiency and effectiveness in fostering a conducive environment for international trade. As Nigeria continues to evolve in the global market, the Nigerian Customs Service remains a cornerstone of its trade infrastructure.