Zurich Insurance Group: Comprehensive Insurance Solutions for a Changing World

Introduction

In today’s rapidly evolving world, having reliable insurance coverage is more important than ever. Zurich Insurance Group, a global leader in the insurance industry, offers a wide range of insurance solutions to meet the diverse needs of individuals, businesses, and organizations. In this blog post, we’ll explore the comprehensive offerings of Zurich Insurance Group, highlighting its commitment to customer satisfaction, innovative solutions, and global reach.

About Zurich Insurance Group

Zurich Insurance Group, headquartered in Zurich, Switzerland, is one of the world’s leading insurance companies. With over 140 years of experience, Zurich provides a broad spectrum of insurance products and services, including general insurance, life insurance, and corporate solutions. The company operates in over 215 countries and territories, ensuring that customers worldwide have access to reliable and tailored insurance coverage.

Comprehensive Insurance Solutions

1. Personal Insurance

Description: Zurich offers a range of personal insurance products designed to protect individuals and families from various risks. These products include:

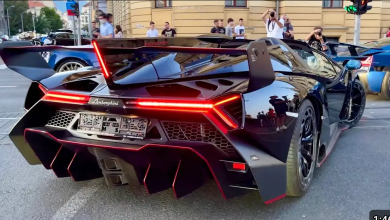

- Auto Insurance: Comprehensive coverage for vehicles, including liability, collision, and comprehensive insurance options.

- Home Insurance: Protection for homes and personal belongings against risks such as fire, theft, and natural disasters.

- Life Insurance: Life insurance policies that provide financial security for loved ones in the event of the policyholder’s death.

- Travel Insurance: Coverage for medical emergencies, trip cancellations, and lost luggage while traveling.

Benefits:

- Customized Coverage: Tailored insurance solutions to meet the unique needs of each individual.

- Financial Security: Ensures financial protection against unexpected events and accidents.

- Global Reach: Access to insurance services and support in numerous countries worldwide.

2. Business Insurance

Description: Zurich Insurance Group offers a comprehensive suite of insurance products for businesses of all sizes. These include:

- Property Insurance: Coverage for commercial properties against risks such as fire, theft, and natural disasters.

- Liability Insurance: Protection against legal liabilities, including general liability, professional liability, and product liability.

- Workers’ Compensation: Coverage for employees in case of work-related injuries or illnesses.

- Cyber Insurance: Protection against cyber threats, data breaches, and other digital risks.

Benefits:

- Risk Management: Comprehensive risk management solutions to protect businesses from various risks.

- Customizable Policies: Flexible insurance options tailored to the specific needs of different industries.

- Global Expertise: Access to Zurich’s extensive knowledge and experience in the global insurance market.

3. Corporate Solutions

Description: Zurich’s corporate solutions provide large multinational corporations with specialized insurance products and services. These include:

- Captive Services: Customized insurance solutions for companies that self-insure through captive insurance companies.

- Multinational Insurance Programs: Coordinated insurance coverage across multiple countries, ensuring consistent protection.

- Credit and Political Risk Insurance: Protection against non-payment risks and political instability in foreign markets.

Benefits:

- Integrated Solutions: Seamless insurance coverage for complex, multinational operations.

- Expertise and Innovation: Access to Zurich’s innovative solutions and global expertise.

- Financial Stability: Strong financial backing and stability, ensuring reliable insurance support.

Commitment to Customer Satisfaction

Zurich Insurance Group is dedicated to providing exceptional customer service and support. The company’s commitment to customer satisfaction is evident through:

- 24/7 Claims Support: Access to round-the-clock claims assistance to ensure timely and efficient resolution of claims.

- Digital Solutions: Innovative digital tools and platforms that simplify the insurance process and enhance the customer experience.

- Local Presence: Strong local presence and expertise in markets worldwide, ensuring personalized and relevant support.

Innovative Solutions for a Changing World

In an ever-changing world, Zurich Insurance Group continuously evolves its products and services to address emerging risks and challenges. The company’s innovative solutions include:

- Sustainability Initiatives: Commitment to sustainability and environmental responsibility, offering green insurance products and supporting sustainable practices.

- Cyber Security: Advanced cyber insurance solutions to protect against the growing threat of cyber-attacks and data breaches.

- Health and Wellness Programs: Comprehensive health and wellness programs to promote employee well-being and reduce healthcare costs.

Zurich Insurance Group: Comprehensive Auto Insurance Solutions

Having reliable auto insurance is essential for protecting yourself and your vehicle from unforeseen events on the road. Zurich Insurance Group, a global leader in the insurance industry, offers comprehensive auto insurance solutions designed to meet the diverse needs of drivers worldwide. In this blog post, we’ll delve into Zurich’s auto insurance offerings, highlighting their benefits, coverage options, and why choosing Zurich can provide you with peace of mind.

Why Choose Zurich Auto Insurance?

Zurich Insurance Group has over 140 years of experience in the insurance industry, providing customers with reliable and tailored insurance products. When it comes to auto insurance, Zurich stands out for several reasons:

1. Comprehensive Coverage Options

Zurich offers a range of auto insurance policies to ensure you have the coverage you need, including:

- Liability Insurance: Covers damages you may cause to other people or property in an accident.

- Collision Insurance: Pays for damages to your vehicle resulting from a collision with another car or object.

- Comprehensive Insurance: Protects against non-collision-related incidents, such as theft, vandalism, and natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers in case of an accident.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who has insufficient or no insurance.

2. Tailored Insurance Solutions

Zurich understands that every driver has unique needs and offers customizable policies to ensure you get the coverage that suits your specific requirements. Whether you’re a new driver, have a family, or own a high-value vehicle, Zurich can tailor its auto insurance solutions to fit your lifestyle and budget.

3. Exceptional Customer Service

Zurich Insurance Group is committed to providing excellent customer service. With 24/7 claims support and a network of experienced agents, Zurich ensures that you receive timely and efficient assistance when you need it most. Their customer-centric approach guarantees that your claims are handled with care and professionalism.

4. Global Expertise and Local Presence

With operations in over 215 countries and territories, Zurich combines global expertise with local knowledge. This extensive reach allows Zurich to offer insurance solutions that are relevant to your specific location and driving conditions, ensuring comprehensive protection no matter where you are.

Key Benefits of Zurich Auto Insurance

1. Financial Protection

Auto insurance provides financial protection against various risks, including accidents, theft, and natural disasters. Zurich’s comprehensive coverage options ensure that you’re protected from potential financial losses, allowing you to drive with confidence.

2. Peace of Mind

Knowing that you have reliable auto insurance coverage from Zurich gives you peace of mind on the road. Whether you’re commuting to work, embarking on a road trip, or simply running errands, you can drive without worrying about the financial implications of an accident or unexpected event.

3. Convenient and Efficient Claims Process

Zurich’s 24/7 claims support ensures that you receive timely assistance when you need it. Their streamlined claims process is designed to be convenient and efficient, minimizing the stress and hassle often associated with filing an insurance claim.

4. Customizable Coverage

Zurich offers customizable auto insurance policies, allowing you to choose the coverage levels and options that best fit your needs. This flexibility ensures that you’re not paying for unnecessary coverage while still receiving the protection you require.

How to Get Started with Zurich Auto Insurance

1. Assess Your Insurance Needs

Evaluate your current auto insurance coverage and identify any gaps or additional coverage you may need. Consider factors such as your driving habits, the value of your vehicle, and your financial situation.

2. Get a Quote

Visit Zurich’s website or contact an agent to get a personalized auto insurance quote. Provide information about your vehicle, driving history, and coverage preferences to receive an accurate quote tailored to your needs.

3. Customize Your Policy

Work with a Zurich agent to customize your auto insurance policy. Select the coverage options and levels that best fit your needs and budget, ensuring comprehensive protection.

4. Review and Purchase

Review your customized policy and make any necessary adjustments. Once you’re satisfied with the coverage, purchase your policy and enjoy the peace of mind that comes with Zurich’s reliable auto insurance.

Conclusion

Zurich Insurance Group stands out as a global leader in the insurance industry, offering comprehensive and innovative insurance solutions to individuals, businesses, and organizations. With a strong commitment to customer satisfaction, extensive global reach, and a focus on addressing emerging risks, Zurich ensures that its customers are well-protected in an ever-changing world.

arewanahiya.com