Opay Business Customers Laud for Leading Fintech Revolution in Nigeria to intersect into advance The Cornerstones of Modern Living

Opay: Pioneering Fintech in Nigeria

Opay Business Customers Laud for Leading Fintech Revolution in Nigeria to intersect into advance The Cornerstones of Modern Living

Introduction

In the ever-evolving world of financial technology (fintech), Opay has emerged as a leading player in Nigeria’s digital landscape. With a range of innovative solutions and services, Opay is transforming the way Nigerians access financial services. In this post, we will explore how Opay’s customers are praising the company for its role in spearheading the fintech revolution in Nigeria.

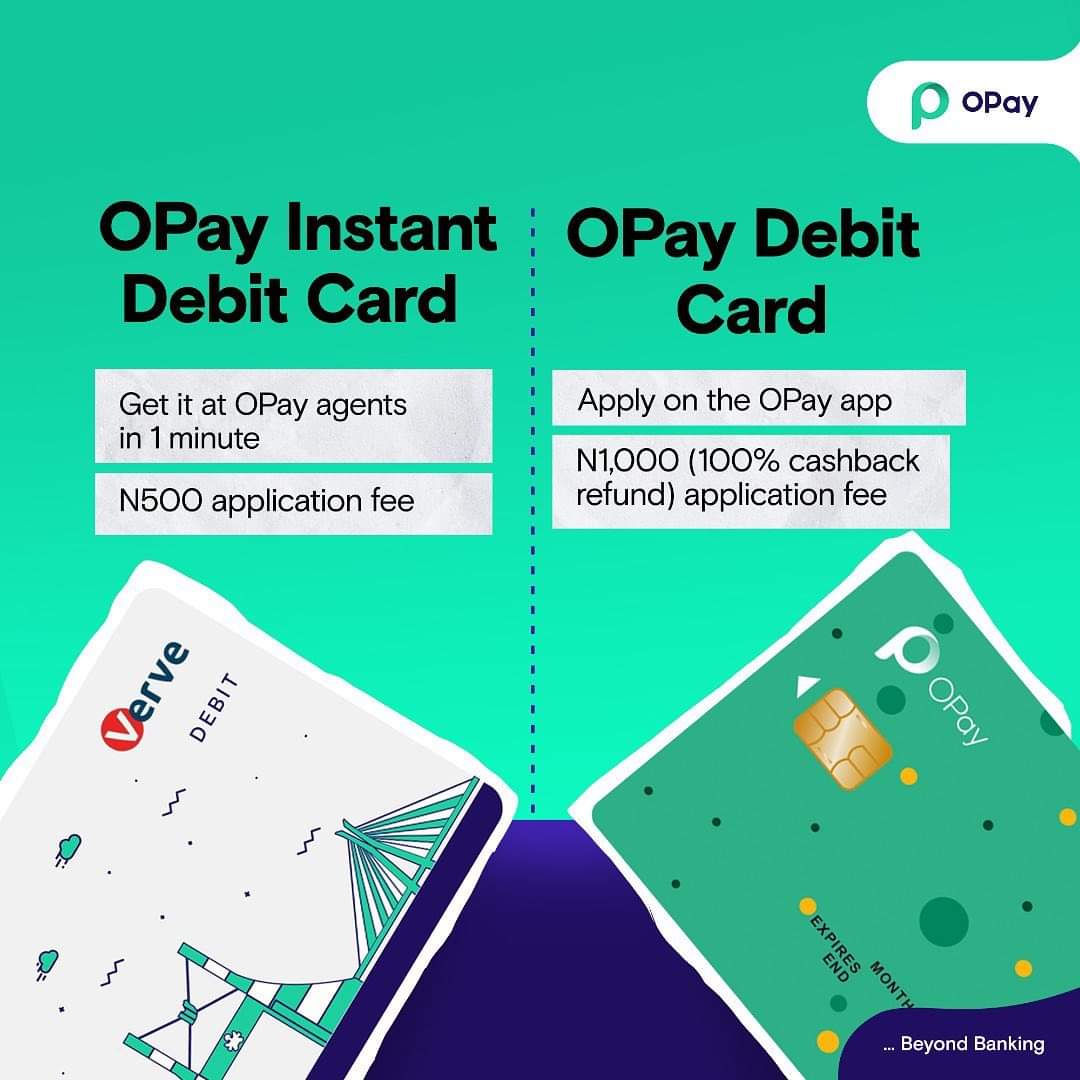

- Opay: Pioneering Fintech in NigeriaOpay, short for OperaPay, is a fintech company that has rapidly gained prominence in Nigeria. It offers a diverse suite of financial services, including mobile payments, ride-hailing, food delivery, and more. Opay’s user-friendly mobile app has become a one-stop solution for various financial needs.

Pro Tip: Provide an overview of Opay’s services and its journey in the Nigerian market.

- Convenience and AccessibilityOpay has made financial services more accessible and convenient for Nigerians. Customers can perform various transactions, from money transfers to bill payments, with just a few taps on their smartphones. This ease of use has garnered praise from users across the country.

Pro Tip: Highlight specific features of Opay’s app that have improved accessibility and convenience.

- Financial InclusionOpay’s services have contributed significantly to financial inclusion in Nigeria. By offering digital financial solutions, Opay has brought previously underserved populations into the formal financial system. Customers in rural and urban areas alike now have access to banking services at their fingertips.

Pro Tip: Share success stories of individuals who have benefited from Opay’s financial inclusion efforts.

- Safety and SecuritySecurity is paramount in the world of fintech, and Opay has made it a priority. The company employs robust encryption and authentication measures to protect users’ financial information. This commitment to security has earned Opay the trust of its customers.

Pro Tip: Discuss the measures Opay has put in place to ensure the safety of user data and transactions.

- Positive Customer ExperiencesOpay’s success is not only measured by its services but also by the positive experiences of its customers. Users have lauded the company for its responsiveness to feedback, quick dispute resolution, and excellent customer support.

Pro Tip: Include testimonials or user stories to showcase the positive experiences customers have had with Opay.

- The Future of Fintech in NigeriaOpay’s role in leading the fintech revolution in Nigeria is a testament to the industry’s potential for growth and innovation. As more Nigerians embrace digital financial solutions, the fintech sector is poised for further expansion and positive transformation.

Pro Tip: Discuss the outlook for the fintech industry in Nigeria and Opay’s potential contributions to its future.

Opay: Pioneering Fintech in Nigeria

In the ever-evolving landscape of financial technology (fintech), Opay has emerged as a trailblazer in Nigeria. With its innovative suite of financial services and digital solutions, Opay is transforming the way Nigerians access and manage their finances. In this post, we will delve into how Opay is pioneering fintech in Nigeria, its impact on the financial sector, and the advantages it brings to both individuals and businesses.

- The Rise of OpayOpay, short for OperaPay, is a fintech company that has gained significant prominence in Nigeria’s financial ecosystem. Established by the Opera Group, Opay offers a wide range of digital financial services, including mobile payments, money transfers, bill payments, and more, all accessible through a user-friendly mobile app.

Pro Tip: Provide an overview of Opay’s inception, its parent company, and its journey in Nigeria’s fintech industry.

- One-Stop Financial SolutionOpay’s mobile app has become a one-stop solution for various financial needs. Whether it’s sending money to family members, paying utility bills, or even ordering groceries, Opay users can conveniently and securely perform these transactions from the comfort of their smartphones.

Pro Tip: Highlight some of the key financial services and features offered by Opay’s app.

- Financial Inclusion and AccessibilityOne of Opay’s most significant contributions is its role in enhancing financial inclusion in Nigeria. By offering digital financial solutions, Opay has brought banking services to the fingertips of millions of Nigerians, bridging the gap between urban and rural areas and extending access to financial services to previously underserved populations.

Pro Tip: Share stories or statistics that illustrate Opay’s impact on financial inclusion in Nigeria.

- Empowering Small BusinessesOpay’s services aren’t limited to individual users. The company has also made significant inroads in supporting small businesses. Through its platform, small business owners can accept digital payments, manage inventory, and access working capital loans, empowering them to thrive in an increasingly digital economy.

Pro Tip: Discuss how Opay’s services benefit small business owners and contribute to economic growth.

- Cutting-Edge SecurityIn the fintech world, security is paramount. Opay takes this responsibility seriously by implementing advanced security measures and encryption protocols. Users can trust that their financial information and transactions are protected from potential threats.

Pro Tip: Explain the security features and measures that Opay employs to ensure user data safety.

- Customer-Centric ApproachOpay’s success is not only attributed to its services but also its customer-centric approach. The company values user feedback, responds swiftly to customer inquiries, and prioritizes positive customer experiences. This has led to a loyal and satisfied user base.

Pro Tip: Include testimonials or user stories that highlight Opay’s commitment to its customers.

Convenience and Accessibility: The Cornerstones of Modern Living

In today’s fast-paced world, convenience and accessibility have become fundamental aspects of our daily lives. From the way we shop and communicate to how we access services and information, these two factors play a pivotal role in enhancing our quality of life. In this post, we will explore the significance of convenience and accessibility in modern living, their impact on various aspects of society, and how technology has revolutionized these key elements.

- Convenience: A Modern NecessityThe pace of life today is relentless, and convenience has emerged as a necessity rather than a luxury. Whether it’s ordering groceries online, using ride-sharing apps, or utilizing digital banking services, convenience is a driving force behind the choices we make in our daily routines.

Pro Tip: Provide examples of how convenience has transformed everyday activities.

- Accessibility: Breaking Down BarriersAccessibility refers to the ability to access goods, services, information, and opportunities without encountering unnecessary barriers. It encompasses physical, digital, and social aspects of life. Achieving accessibility is essential for ensuring that everyone can participate fully in society, regardless of their abilities or circumstances.

Pro Tip: Discuss the importance of accessibility in creating an inclusive and equitable society.

- Technology’s Role in ConvenienceTechnology, particularly mobile devices and the internet, has revolutionized convenience. Mobile apps, e-commerce platforms, and on-demand services have brought convenience to our fingertips. Whether it’s hailing a ride, ordering food, or managing finances, technology has simplified these tasks.

Pro Tip: Highlight specific technologies and apps that have reshaped convenience.

- Digital Accessibility: A Global ShiftThe digital revolution has also paved the way for greater accessibility. The internet has democratized access to information, education, and job opportunities. Advances in assistive technology have made it possible for individuals with disabilities to navigate the digital world with ease.

Pro Tip: Discuss the transformative impact of digital accessibility on education, employment, and social inclusion.

- Economic and Environmental ImplicationsConvenience often comes with economic and environmental considerations. While it can boost efficiency and productivity, it can also lead to overconsumption and environmental challenges. Finding a balance between convenience and sustainability is a key issue for society.

Pro Tip: Explore the economic and environmental trade-offs associated with convenience.

- Challenges and Ethical ConsiderationsConvenience and accessibility raise important ethical questions. Issues like data privacy, digital divide, and the impact on local businesses need to be addressed. Striking a balance between convenience, accessibility, and ethics is an ongoing societal challenge.

Pro Tip: Discuss ethical dilemmas and the need for responsible use of technology.

Conclusion

Opay’s customers have spoken, and their praise for the company’s role in revolutionizing fintech in Nigeria is resounding. Opay’s commitment to convenience, accessibility, financial inclusion, safety, and positive customer experiences has made it a game-changer in the Nigerian financial landscape. As the company continues to innovate and expand its services, it is poised to play a vital role in shaping the future of fintech in Nigeria, making financial services more accessible and convenient for all Nigerians.