How To Apply for Top 10 Ecobank Loans With No Collateral Required Using Mobile App | Apply Auto Loan and Others.

Introduction:

In today’s fast-paced world, access to quick and hassle-free loans can be a game-changer. Ecobank, one of Africa’s leading financial institutions, has made this a reality by offering a range of loans without the need for collateral. What’s even better? You can apply for these loans conveniently through their mobile app. In this blog post, we will guide you through the steps to apply for the top 10 Ecobank loans with no collateral required using the mobile app, including auto loans and more.

Why Choose Ecobank for Loans?

Before we dive into the application process, let’s briefly discuss why Ecobank is an excellent choice for obtaining loans:

- Extensive Network: Ecobank operates in over 30 African countries, making it easily accessible to a wide range of customers.

- No Collateral Required: Unlike traditional loans that often require collateral, Ecobank offers several loan options with no collateral needed.

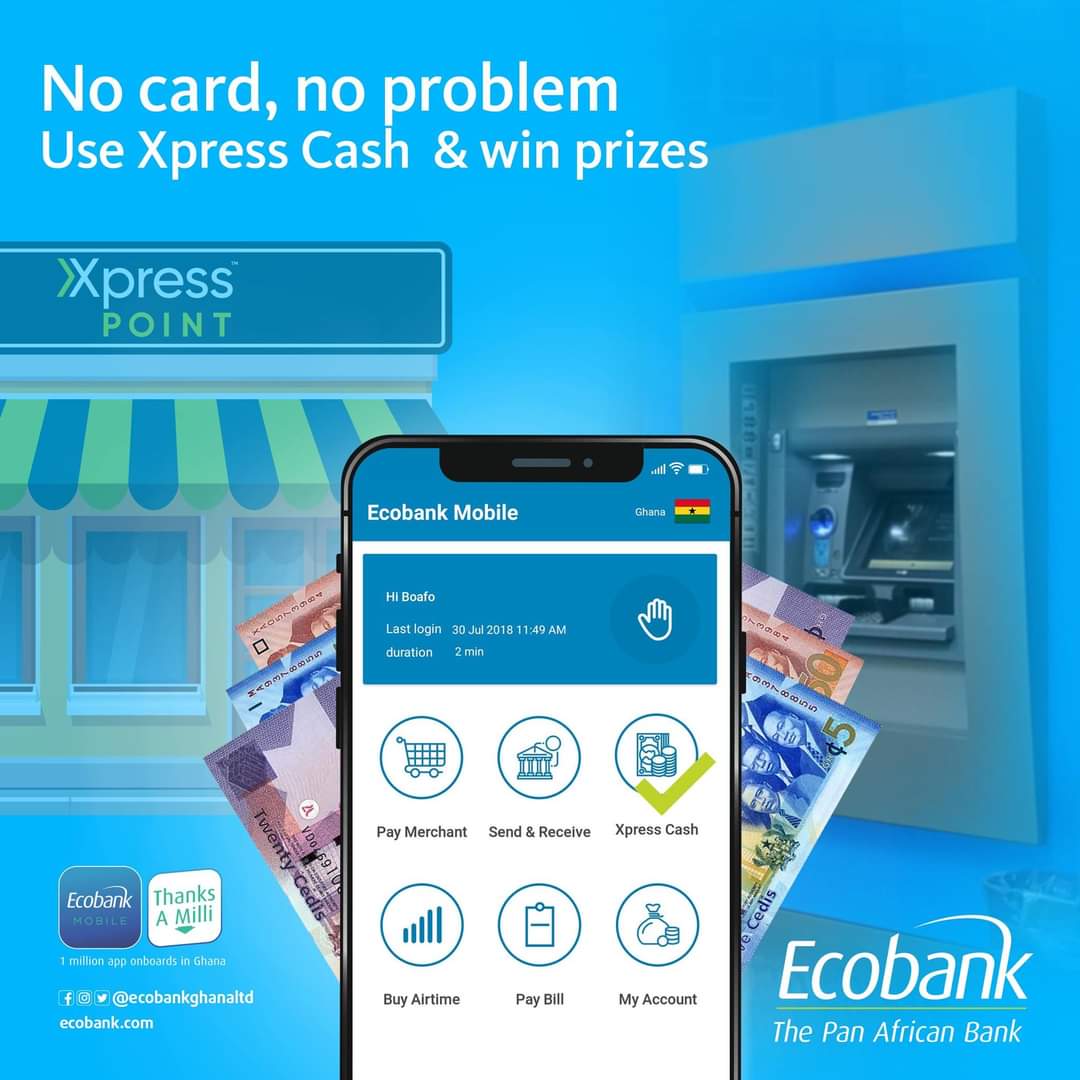

- Convenient Mobile App: Applying for a loan has never been easier, thanks to the user-friendly Ecobank mobile app.

Now, let’s explore how you can take advantage of these benefits by applying for loans through the Ecobank mobile app.

Step-by-Step Guide: Applying for Ecobank Loans via Mobile App

Step 1: Download the Ecobank Mobile App

If you haven’t already, head to your device’s app store and download the Ecobank mobile app. It’s available for both Android and iOS.

Step 2: Register or Log In

Once the app is installed, open it and either register for a new account or log in if you already have one. Ensure your account is verified and linked to your mobile number.

Step 3: Navigate to “Loans” Section

Within the app, navigate to the “Loans” or “Credit” section. This is where you’ll find all the available loan options.

Step 4: Choose Your Loan Type

Ecobank offers various loan products, including personal loans, auto loans, business loans, and more. Select the type of loan you need, such as an auto loan.

Step 5: Fill in Your Information

Provide the necessary information requested by the app, including your personal details, employment information, and the loan amount you require. Make sure to double-check your entries for accuracy.

Step 6: Review and Submit

Before submitting your loan application, carefully review all the provided information to ensure it’s accurate and complete. Any discrepancies could lead to delays.

Step 7: Wait for Approval

Ecobank will review your loan application, and if you meet the eligibility criteria, your loan will be approved. The approval process typically takes a short time, thanks to the efficiency of the mobile app.

Step 8: Receive Your Funds

Once your loan is approved, the funds will be disbursed directly to your Ecobank account, making it accessible for your intended use.

How to Download the Ecobank Mobile App

In an increasingly digital world, the convenience of banking at your fingertips is a game-changer. The Ecobank mobile app offers a seamless banking experience, allowing you to manage your finances, make transactions, and access various banking services from the comfort of your mobile device. In this post, we will guide you through the simple steps to download the Ecobank Mobile App.

Why Choose the Ecobank Mobile App?

Before we dive into the download process, let’s explore some of the benefits of using the Ecobank Mobile App:

- 24/7 Access: Access your bank account and perform transactions at any time, day or night, from anywhere in the world.

- Secure and Convenient: Ecobank prioritizes the security of your financial data. The app is designed with advanced security features to keep your information safe.

- Full Control: You can manage your accounts, transfer funds, pay bills, and even apply for loans all within the app, giving you complete control of your finances.

- User-Friendly Interface: The app is designed with a user-friendly interface, making it easy for both tech-savvy individuals and those new to mobile banking.

Now, let’s get started with downloading the Ecobank Mobile App.

Step-by-Step Guide: Downloading the Ecobank Mobile App

Step 1: Visit Your App Store

Depending on your device’s operating system, open either the Google Play Store (for Android users) or the Apple App Store (for iOS users) on your mobile device.

Step 2: Search for “Ecobank Mobile App”

In the search bar at the top of the app store, type in “Ecobank Mobile App” and hit “Search.”

Step 3: Locate the Ecobank Mobile App

From the search results, you should see the Ecobank Mobile App listed. It typically features the Ecobank logo as its icon.

Step 4: Download and Install

Tap on the Ecobank Mobile App to open its details page. You will see an option to “Download” or “Install.” Tap on this option.

Step 5: Accept Permissions

The app may require certain permissions to function correctly. Be sure to review the permissions and, if acceptable, tap “Accept” or “Allow.”

Step 6: Wait for Installation

The app will download and install on your device automatically. This process may take a few moments, depending on your internet connection speed.

Step 7: Open the App

Once the installation is complete, tap “Open” to launch the Ecobank Mobile App.

Step 8: Register or Log In

If you already have an Ecobank account, log in using your existing credentials. If you’re new to Ecobank, you can register for a new account directly within the app.

How to Register or Log In to the Ecobank Mobile App

Registering for and logging into the Ecobank Mobile App is your gateway to a world of convenient and secure banking services. Whether you’re a new customer looking to create an account or an existing customer ready to access your accounts, this post will guide you through the simple steps to register or log in to the Ecobank Mobile App.

Registering for an Ecobank Account:

If you’re new to Ecobank and need to create an account to access the mobile app, follow these steps:

Step 1: Download the Ecobank Mobile App

Before you can register, ensure you have downloaded and installed the Ecobank Mobile App from your device’s app store. You can follow the steps in our previous post, “How to Download the Ecobank Mobile App,” to get the app on your device.

Step 2: Open the App

Tap on the Ecobank Mobile App icon to open it.

Step 3: Select “Register”

On the app’s main screen, you will see an option to “Register” or “Sign Up.” Tap on this option.

Step 4: Fill in Your Information

Follow the on-screen instructions to provide the required information, including your full name, email address, phone number, and other necessary details. Be sure to double-check your entries for accuracy.

Step 5: Create a Secure Password

Choose a strong and unique password for your account. A strong password typically includes a combination of letters, numbers, and special characters. This password will be used to log in to your account, so keep it safe.

Step 6: Verify Your Identity

Ecobank may require you to verify your identity for security purposes. This may involve receiving a one-time password (OTP) via SMS or email, which you will need to enter in the app to complete the registration process.

Step 7: Agree to Terms and Conditions

Review and accept Ecobank’s terms and conditions, as well as any privacy policies. This step is essential to proceed.

Step 8: Registration Complete

Once you’ve completed all the steps and your information is verified, your registration process is complete. You can now log in to the app using your newly created credentials.

Logging In to the Ecobank Mobile App:

If you’re already a registered Ecobank customer and need to log in to the mobile app, here’s how:

Step 1: Open the App

Launch the Ecobank Mobile App on your device.

Step 2: Select “Log In”

On the app’s main screen, tap the “Log In” or “Sign In” option.

Step 3: Enter Your Credentials

Provide your registered email address or phone number and the password you created during the registration process.

Step 4: Log In

Tap the “Log In” button, and you’ll gain access to your Ecobank account.

The Convenience of Banking with the Ecobank Mobile App

The Ecobank Mobile App is not just your ordinary banking application; it’s a powerful tool that brings banking convenience right to your fingertips. In this post, we’ll explore how the Ecobank Mobile App can transform the way you manage your finances, offering you a seamless and hassle-free banking experience.

Why Choose the Ecobank Mobile App?

Before we dive into the specifics, let’s highlight some key reasons why choosing the Ecobank Mobile App is a smart decision:

- Accessibility: With the app, you can access your bank accounts and financial services 24/7, no matter where you are.

- User-Friendly Interface: The app boasts an intuitive design that caters to users of all levels of tech-savviness, ensuring that banking is easy for everyone.

- Security: Ecobank prioritizes your security, implementing robust security measures to safeguard your financial data and transactions.

- Comprehensive Services: From checking balances to making payments, transferring funds, applying for loans, and more, the app offers a wide range of banking services in one place.

Now, let’s explore how the Ecobank Mobile App makes banking more convenient.

1. Balance Inquiry:

The Ecobank Mobile App allows you to check your account balances in real-time. No need to visit a branch or ATM – your account information is just a tap away.

2. Fund Transfers:

Easily transfer money between your accounts or send funds to other Ecobank accounts. You can also make interbank transfers, all within the app.

3. Bill Payments:

Pay your bills conveniently through the app. Whether it’s utilities, credit cards, or subscriptions, you can settle your payments without leaving your home.

4. Airtime and Data Purchase:

Top up your mobile phone or purchase data bundles directly from the app. Stay connected with just a few taps.

5. Loan Applications:

Need a loan? Apply for various types of loans, including personal loans and auto loans, through the app. The application process is straightforward and streamlined.

6. Card Services:

Manage your Ecobank debit and credit cards easily. Block or unblock your cards, set spending limits, and view transaction history.

7. Branch and ATM Locator:

Find the nearest Ecobank branches and ATMs using the app’s built-in locator. No more searching for cash withdrawal points.

8. Alerts and Notifications:

Stay informed about your account activity through alerts and notifications. Receive updates on transactions, account balances, and more.

9. Customer Support:

Access customer support directly from the app. If you have any questions or concerns, assistance is just a message or call away.

10. Security Features:

Enjoy peace of mind with advanced security features, including PIN protection, biometric login, and encryption to safeguard your financial information.

Conclusion

Securing a loan without collateral has never been more accessible than with Ecobank’s user-friendly mobile app. Whether you need an auto loan or any other type of loan, the top 10 Ecobank loans offer financial solutions tailored to your needs.

Remember to use this guide when applying for your loan and ensure you meet all the eligibility requirements. With Ecobank’s commitment to financial inclusivity and convenience, you can confidently apply for the loan you need using their mobile app.

Don’t miss out on this opportunity to meet your financial goals. Download the Ecobank mobile app today and start your hassle-free loan application journey.

Disclaimer: Loan approval is subject to Ecobank’s terms and conditions. Interest rates, repayment terms, and eligibility criteria may vary. Be sure to read and understand all terms before applying for a loan.