Lates News Today, 15th July 2023: POS Operators Increase Charges for Withdrawal and Deposit

Introduction:

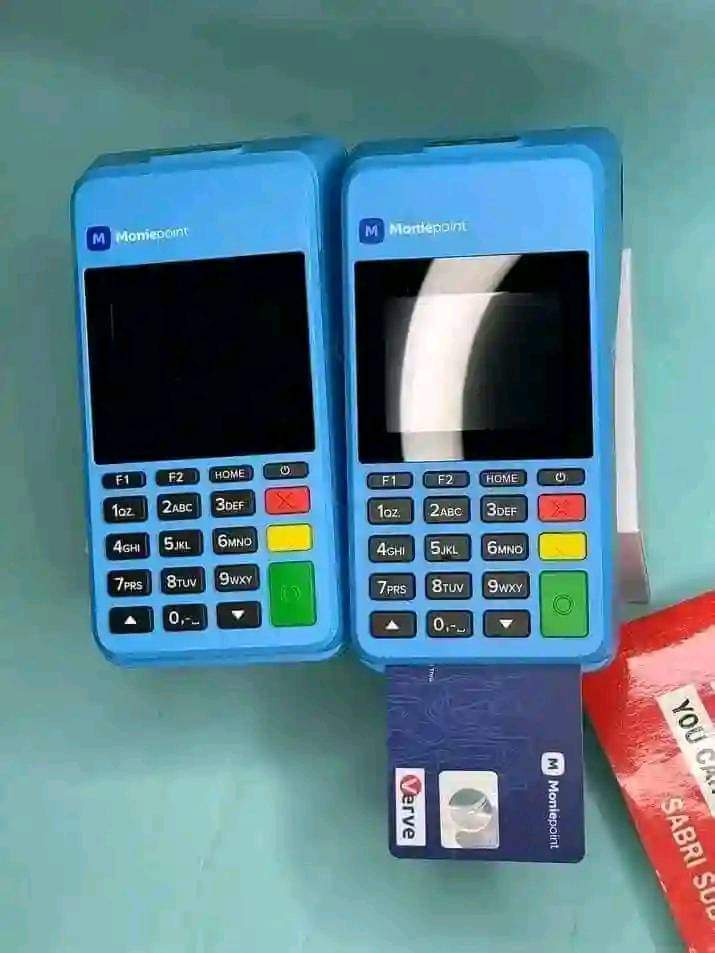

In a significant development impacting financial transactions, there has been a hot announcement made today, 15th July 2023, regarding an increase in charges for withdrawal and deposit transactions carried out through Point of Sale (POS) machines. This announcement has raised concerns and discussions among consumers and businesses alike. In this SEO post, we delve into the details of this announcement, its implications, and what it means for individuals and businesses relying on POS services.

Key Topics Covered:

- Overview of the Announcement

- Increased Charges for Withdrawal Transactions

- Increased Charges for Deposit Transactions

- Reasons behind the Increase

- Impact on Consumers and Businesses

- Alternatives and Mitigation Strategies

- Conclusion

- Overview of the Announcement: The hot announcement made today, 15th July 2023, pertains to an increase in charges for withdrawal and deposit transactions carried out through POS machines. POS operators have revised their fee structure, resulting in higher charges for these transactions.

- Increased Charges for Withdrawal Transactions: Customers using POS machines for cash withdrawal will experience an increase in the transaction fees. The new charges imposed by POS operators will be higher than the previous rates, affecting the cost of withdrawing cash through this popular payment method.

- Increased Charges for Deposit Transactions: Similarly, the announcement includes an increase in charges for deposit transactions made through POS machines. Customers or businesses using POS machines to deposit cash will also face higher transaction fees compared to the previous rates.

- Reasons behind the Increase: The exact reasons behind the increase in charges for POS transactions may vary and depend on the policies and decisions of individual POS operators. Some potential factors contributing to the increase may include rising operational costs, regulatory changes, infrastructure investments, or efforts to enhance profitability.

- Impact on Consumers and Businesses: The increased charges for POS transactions can have significant implications for both consumers and businesses. Consumers relying on POS services for cash withdrawals and deposits may experience higher transaction costs, which can impact their personal finances. Small businesses and merchants accepting POS payments may also face increased expenses, affecting their profit margins.

- Alternatives and Mitigation Strategies: In light of the increased charges, individuals and businesses may explore alternative payment methods or consider mitigation strategies to minimize the impact. Some options to consider include:

- Exploring other digital payment options, such as mobile wallets or online banking transfers.

- Encouraging customers to use alternative payment methods, such as bank transfers or mobile payment apps.

- Evaluating the cost-effectiveness of maintaining POS services and considering alternative payment solutions.

- Negotiating fees and charges with POS operators to potentially reduce the impact on transactions.

Overview of the Announcement

The hot announcement made today, 15th July 2023, relates to an increase in charges for withdrawal and deposit transactions carried out through Point of Sale (POS) machines. POS operators have revised their fee structure, resulting in higher transaction costs for these types of transactions.

This announcement has significant implications for both consumers and businesses. Individuals who rely on POS services for cash withdrawals and deposits will experience an increase in transaction fees, potentially impacting their personal finances. Similarly, small businesses and merchants that accept POS payments will face higher expenses, which can affect their profit margins.

The reasons behind the increase in charges may vary, and they can be influenced by factors such as rising operational costs, regulatory changes, infrastructure investments, or the aim to enhance profitability for POS operators. The exact motivations for the increase may differ among individual operators.

With these increased charges, individuals and businesses may need to explore alternative payment methods or consider mitigation strategies to minimize the impact. This could involve exploring other digital payment options like mobile wallets or online banking transfers, encouraging customers to use alternative payment methods, evaluating the cost-effectiveness of maintaining POS services, or negotiating fees with POS operators.

It’s important for individuals and businesses to stay informed about any further developments or announcements in the financial industry to navigate the changing landscape of payment services. Monitoring updates from POS operators and financial institutions will provide insights into the ongoing situation and potential adjustments to transaction charges in the future.

Increased Charges for Withdrawal Transactions

As per the hot announcement made today, 15th July 2023, there has been an increase in charges for withdrawal transactions carried out through Point of Sale (POS) machines. This means that customers who use POS services to withdraw cash will experience higher transaction fees compared to the previous rates.

The specific details of the increased charges may vary depending on the policies and decisions of individual POS operators. However, it is important for consumers to be aware that the cost of cash withdrawals through POS machines has risen.

The reasons behind the increase in charges can include factors such as rising operational costs, regulatory changes, infrastructure investments, or efforts to enhance profitability for POS operators. These factors may influence the decision to revise the fee structure for withdrawal transactions.

It is essential for individuals who frequently use POS services for cash withdrawals to consider the impact of these increased charges on their personal finances. They may need to review their cash management strategies or explore alternative payment methods to minimize transaction costs.

Staying informed about the specific charges imposed by individual POS operators and any potential updates or changes in the future will help individuals make informed decisions regarding their cash withdrawal preferences and financial planning.

Increased Charges for Deposit Transactions

In light of the hot announcement made today, 15th July 2023, there has been an increase in charges for deposit transactions carried out through Point of Sale (POS) machines. This means that customers or businesses using POS services to deposit cash will encounter higher transaction fees compared to the previous rates.

The exact details of the increased charges may vary depending on the policies and decisions of individual POS operators. However, it is important for individuals and businesses to be aware that the cost of depositing cash through POS machines has escalated.

Several factors could contribute to the increase in charges for deposit transactions. These factors may include rising operational costs, regulatory changes, infrastructure investments, or efforts to improve profitability for POS operators. Each POS operator may have their own specific reasons for revising the fee structure for deposit transactions.

Customers or businesses relying on POS services to deposit cash should consider the impact of these increased charges on their financial activities. It may be beneficial to review alternative payment methods or assess the cost-effectiveness of maintaining POS services for deposit transactions.

Staying informed about the specific charges set by individual POS operators and monitoring any updates or changes in the future will help individuals and businesses make informed decisions regarding their deposit preferences and financial management strategies.

Conclusion:

The hot announcement today, 15th July 2023, regarding increased charges for withdrawal and deposit transactions through POS machines has triggered discussions and concerns among consumers and businesses. The revised fee structure imposed by POS operators will result in higher transaction costs for cash withdrawals and deposits. It is important for individuals and businesses to assess the impact of these changes on their financial activities and consider alternative payment options or mitigation strategies. Staying informed about any further developments or announcements in the financial industry will help navigate the evolving landscape of payment services.